Sustainable Investing & Green bonds in Australia

January 4, 2019, via LinkedIn

Last month – actually, I’ve had this open on my laptop for some time so maybe a few months ago now – I received the Byron Mayor’s email newsletter, with a particularly interesting announcement regarding Council’s recent investment in a ‘Sustainability Bond’ by Bank Australia.

“The Sustainability Bond offer from Bank Australia was originally a total investment pool of $100 million. It was expanded to $125 million and they received offers of $250 million. As the investment was oversubscribed, Council sought a $1 million investment into the Sustainability Bond but was allocated $500,000. “

– Byron Mayor’s newsletter, September 2018

This announcement piqued an interest I’ve had in green bonds since (i) being told by a member of Social Ventures Australia that there wasn’t a current workable precedent for financing affordable/ sustainable housing projects, and (ii) attending The Centre for Policy Development’s public forum in Sydney a year ago on ‘Building a sustainable economy’ (the topic of my last Linked in article), where both Geoff Summerhayes (APRA) and Christina Tonkin (ANZ) referenced the growing green bond market, expected to grow from some hundred billion to over US$5 trillion in less than 20 years.

I volunteer my time to a local not for profit exploring options for affordable housing in the Byron Shire, and it had previously occurred to me that green bonds may be an interesting vehicle with which to raise funds. So when the Mayor’s newsletter stated that “The investment offer from Bank Australia will use the proceeds from investors to fund the following loans:

- To not for profit organisations and specialist accommodation housing

- For affordable housing

- For the construction of green buildings

- For conservation backed construction

- Ongoing mortgage loans for energy efficient homes

My interest was officially piqued. I decided it was time to take a closer look at this market. Below are my findings.

1. RESPONSIBLE INVESTMENTS ACCOUNT FOR 50% OF MANAGED INVESTMENTS IN AUSTRALIA

“$1 of every $2 invested in Australia today is done so by social, environmental or ethical investors.”

– Christina Tonkin, ANZ, Building a sustainable economy forum, November 2018

I found this statistic quoted by Christina Tonkin at CPD’s public forum last year surprisingly high at the time, as did my economist friend Thomas Keily, however I was previously unable to find the source of this statistic last year.

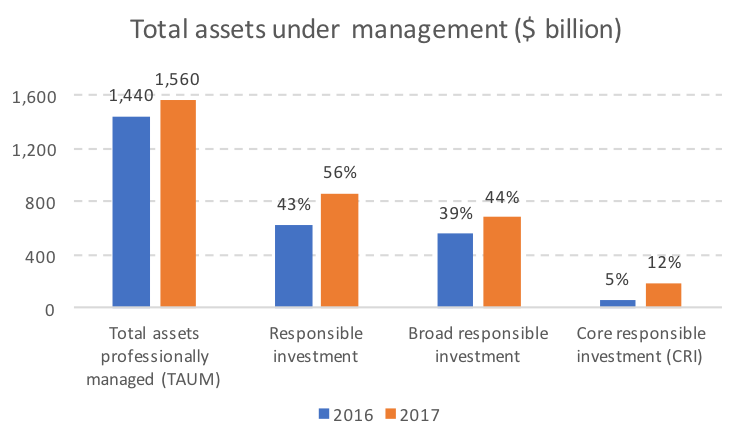

There is $1.5 trillion of total assets professionally managed (TAUM) in Australia. Of this, ‘responsible investment’ now accounts for over half of TAUM.

Source: Responsible Investment Association Australasia

“Responsible Investment” reportedly includes assets managed through a ‘broad responsible investment strategy’, which ‘undertake a leading approach to ESG integration’. I wonder if the green jam that Sony used to produce as part of their CSG activities in Berlin in 2008 would count here.

My two cents on why this figure is at 50% relative to the proportion of Australians wanting to act sustainably or responsibly? Corporate boards are still predominantly composed of old white males and the manager of an insurance firm I recently consulted to still denied the threat of climate change in 2018, so I don't believe that companies have suddenly grown a conscience. I think responsible investing has increased for two main reasons: (i) as figures show, its often more profitable from a portfolio perspective, and (ii) the risk of not doing so has increased. At this stage I think its a box ticking exercise with a relatively low cost/ high return.

2. CORE RESPONSIBLE INVESTMENTS ACCOUNT FOR 12% OF MANAGED INVESTMENTS IN AUSTRALIA

Whereas “responsible investment” refers to assets managed via a broad responsible investment strategy, “core responsible investment” approaches apply at least one of the following primary strategies:

i) negative, positive or norms based screening;

ii) sustainability themed investing;

iii) impact investing and community finance; or

iv) corporate engagement.

Importantly, funds are only included in Core screening approach where at least two screens/exclusions are in place (Responsible Investment website)

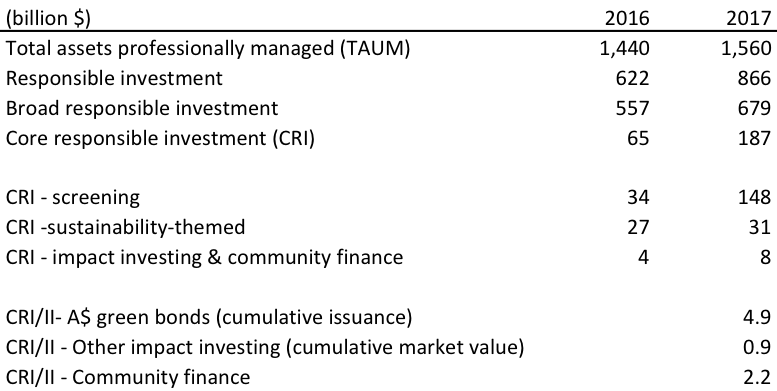

There has been a 188% increase of assets under management (AUM) subject to Core responsible investment strategies, to $186.7 billion in 2017 (from $64.9 billion in 2016). Core responsible investment as a proportion of Australia’s TAUM increased to 12.0% in 2017, up from 4.5% in 2016.

Source: responsibleinvestment.org

“Funds implementing Core responsible investment strategies outperform their equivalent Australian and international share funds and multi-sector growth funds, over most time horizons.”

– Responsibleinvestment.org

The positive impact of ESG integration on portfolio performance and the increasing demand from institutional investors, are identified as the key drivers of growth in core responsible investment AUM.

This sounds positive. However, once you look at the data more closely, you see very quickly that the majority of growth has come from a 440% increase in ‘screening’ between 2016-2017.

Source: Responsible Investment Benchmark Report 2018

3. SCREENING ACCOUNTS FOR 9% OF MANAGED INVESTMENTS IN AUSTRALIA

Whilst core responsible investment grew from 2016-2017, the majority of these investments are in screening versus direct investments, accounting for 79% of core responsible investment strategies.

Source: Climate Bonds Initiative; Responsible Investment Association Australasia

Screening is a good first start, however still relatively conservatively oriented, with the frequency of funds screening for adult content-related issues higher than screening for environment and climate-related issues.

Source: Responsible Investment Benchmark Report 2018

4. SUSTAINABILITY THEMED INVESTMENTS & GREEN BONDS COLLECTIVELY ACCOUNT FOR 2% OF MANAGED INVESTMENTS IN AUSTRALIA

‘Sustainability-themed investing’ increased a more modest 14% over this period, due largely to organic growth in the investments reported in the prior year as opposed to new investments (RenewEconomy). The category of ‘impact investing and community finance’ – a diverse category including dedicated impact investment funds, green and climate bonds, responsible banking products and community finance, grew by 94%.

Source: Climate Bonds Initiative; Responsible Investment Association Australasia

5. GREEN BONDS ACCOUNT FOR LESS THAN 1% OF AUSTRALIAN MANAGED INVESTMENTS IN AUSTRALIA

"Nearly one in every two institutional investor dollars are committed to a responsible investment approach. But it's only been the last two years that we've seen a real take off in green bond issuances in Australia"

– Simon O’Connor, Chief Executive, Responsible Investment Association of Australia, 2018

Ever since the Industrial Revolution, bonds have played a critical role in financing infrastructure in cities and towns. A green bond transforms these infrastructure-related investments into low-carbon, climate change-resilient alternatives.

Today, investors assess risk not just in terms of financial risk, but also social, environmental and governance (ESG) issues that may be critical to financial returns. Investors are reportedly demanding that investment firms start to factor in ESG components. Green bonds, debt finance tools that have traditionally been used to raise long-term capital with low risk, may be answering the call for behavioural change in the financial sector.

“For a long time, socially responsible investing and its products were a niche market. However, with the advent of the green bond, this niche market is transitioning to the mainstream."

– The Conversation, 2018

Green Bonds globally

The green bond market opened up in 2007 with the AAA-rated issuance from European Investment Bank (EIB) and World Bank. By 2016, issuance of these types of bonds hit a record and accounted for $US93 billion globally. This figure more than doubled in 2017.

Source: Climate Bonds Initiative; Responsible Investment Association Australasia

“Governments and public institutions account for almost 68 per cent of global green bond issuance and developing countries such as China are currently leading the market”

– The Conversation, 2018

Governments appear to have pump-primed the market, and new regulations are further driving corporate uptake. Several countries are issuing what are known as green economy road maps, which are reportedly driving corporate demand for green bonds and private sector green bonds are on the rise. (Source: The Conversation) Under the ‘Chinese Green Credit Guideline Policy’, banks have reduced how much environmental risk they expose themselves to, especially when lending to their clients.

Green bonds in Australia

Green bond markets have developed in Australia without any formal market infrastructure or policy support, in contrast to the regulator-led stimulation in neighbouring China, India and certain South East Asian markets (Climate Bonds report).

Source: CEFC

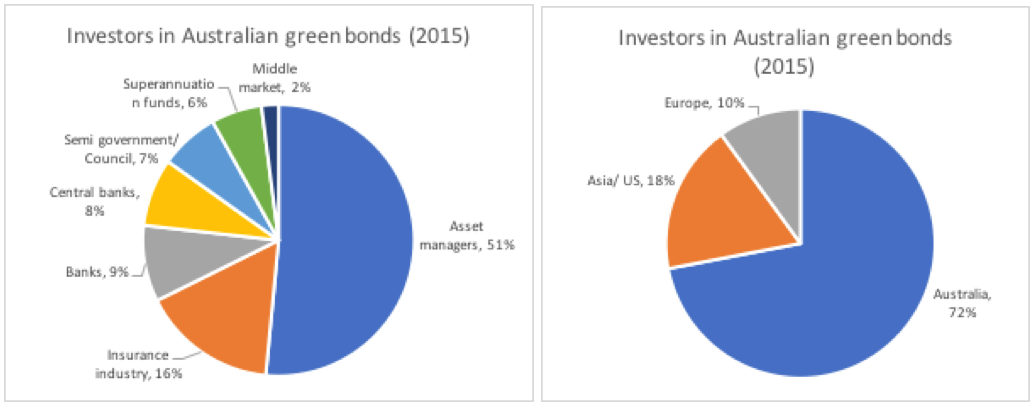

It is expected that its A$2.6 trillion superannuation fund pool, the fourth largest in the world, will underpin growing demand for Australia’s emerging green bond market.

Around 25% of Australia’s superannuation market is currently invested in fixed income, below Canada (40%), UK (45%) and South Korea (95%), and funds are reportedly seeking more ESG based investment opportunities.

It is promising to note the already significant share of investment by the ‘semi-government’ segment including local Councils. One wonders whether Councils will in the future be able to issue and invest in their own projects, given their dual infrastructure and investment capacities.

6. AUSTRALIA IS CONSIDERED A LEADER IN THE GLOBAL GREEN BOND MARKET

Certified green bonds in Australia

Internationally, Australia is a leader in certification under the Climate Bonds Standard with 12% of global certified volume, making it the third largest source of certified issuance after China and USA (Climate Bonds report). 100% of Australian issuance has received an external review with 85% Certified Climate Bonds, denoting that it meets the Climate Bonds Standard and sector specific criteria (Climate Bonds Initiative website).

Green bond issuers in Australia

Despite an unfavourable policy backdrop, Australian banks, sub-sovereigns and corporate issuers have been global and regional leaders in the green bond market. Australian entities were the first issuers of green bonds in the Asia Pacific region. Australia was the second largest source of green bond issuance in the Asia Pacific region in the first half of 2018, behind China, and 12th in the world, outpacing even large bond markets like Japan.

Financial institutions have driven market growth, with the four major banks – NAB, ANZ, Westpac and CBA having issued Certified Climate Bonds. As green underwriters the banking sector is also a source of vital support for other new issuers including local government, corporates non-bank lenders and the tertiary sector, advising on the green issuance process, market conditions and investor appetite.

NAB issued Australia’s first green bond in December 2014. Initially set to raise $150 million, NAB doubled the size of the issue, taking it to $300 million, to meet strong investor demand. The bond was certified by the Climate Bonds Initiative with proceeds to be applied to a number of wind and solar farms. ANZ, Westpac and CBA followed course in 2015, 2016 and 2017. In addition to the big four banks, both the Victorian (2016) and Queensland (2017) Treasury Corporations have issued certified green bonds, for uses including LED traffic lights, renewable energy infrastructure, low carbon building and low carbon transport infrastructure (eg rail & cycle ways).

Monash was the first university to issue a green bond in the US market in 2016 to finance its sustainability and emissions targets.

Australian property funds and insurers are amongst the first corporates to issue green bonds, beginning with Stockland’s uncertified Euro issuance in 2014 and including leasing company Flexicorp’s $50m green certified asset backed security issuance in 2016 for refinancing of rooftop solar projects. Australia’s QBE Insurance Group sold the world’s first green insurance bond last year.

Non-banking institution issuers of impact investments include Foresters, Social Ventures Australia, Social Enterprise Finance Australia, Impact Investment Group, Indigenous Business Australia, The Nature Conservancy, FlexiGroup and the Victorian Government.

Banks such as Teachers Mutual Bank, Bank of Australia and Community Sector Banking focus on microfinance, social impact or affordable housing.

Use of proceeds of green bonds in Australia

The majority of green bonds in Australia to date have been issued for renewable energy generation (over 50MW), primarily wind and solar. Green building, sustainable waste management and low carbon transport projects (including greenways and bike boulevards in South Australia) are also being financed. Further opportunities exist in sustainable water management and infrastructure and systems for long term climate and drought resilience.

Green bonds have an average tenor of 9 years, with some long tenor bonds already issued like Monash University’s A$218m green bond issued In the US in 2016 (25 years).

Bank Australia defines the use of proceeds to include

- Socioeconomic advancement and empowerment: Commercial Loans to NFP entities

- Affordable housing: commercial loans for community housing to groups registered with the national registry scheme for community housing; or residential mortgages to government sponsored and administered affordable housing schemes

- Green buildings: commercial loans to build, renovate or operate 7 star + buildings under the Nationwide House Energy Rating Scheme (NatHERS)

- Environmentally sustainable management of living natural resources and land use: residential mortgages related to Bank Australia’s Conservation Reserves

I note, with reference to my initial interest, that despite claiming to be allocating proceeds to ‘affordable housing’, the above guidelines appear to be for ‘community housing’ (which sounds more like social housing to me) and government schemes, which don’t appear to include privately provided affordable housing schemes.

Use of proceeds of green bonds globally

Globally, use of funds are similar, with increasing diversity reflective of slightly more mature markets.

Source: Climate Bonds Initiative, Green Bonds Highlights, 2017

7. GREEN COULD BE THE NEW BLACK IN DEBT MARKETS

Five years ago, during my time at News Corp, I used to tell my publishing colleagues (whose portfolio at the time included Vogue & Gardening Australia) that green was the new black. Given the high rate of broad responsible investing and screening in Australia, the depth of superannuation fund pools, increasing risk profiles of 'old' industries and increasing demand by stakeholders for sustainable investments, further greening of Australian bond markets looks certain. Fingers crossed that it translates to sustainable, innovative and well managed projects in both public and private sectors.

___

Caveat on data: This was written across small gaps of solitude between caring for two small children in the Byron hinterland. Other than facts taken from the CPD event I attended last year, it is based on desktop research and paraphrases but doesn’t always remember to quote. If you have updated information, corrections or questions on any of the data, please get in touch and I’ll continue to update the data online.

References

AFR, ‘Australian social impact market hits 6 billion’, 2018

Bank Australia website

Clean Energy Finance Corporation (CEFC), ‘Australia’s budding green bond market’, 2015

Climate Bonds Initiative, ‘Australia New Zealand Country Briefing; Green Bonds Highlights, 2017’ & ‘Green Infrastructure list’

The Conversation, ‘Green bonds are taking off and could help save the planet’, 2018

Corrs, ‘Green bond market – an Australian focus’, 2018

Renew Economy, chart via Bloomberg New Energy Finance

Responsible Investment Benchmark Report Australia, 2018

Reuters, ‘Australia green bond market muzzled by policy uncertainty’, 2018